Long-term Bitcoin holders’ transfer volume remains low amid price corrections in 2024

Onchain Highlights

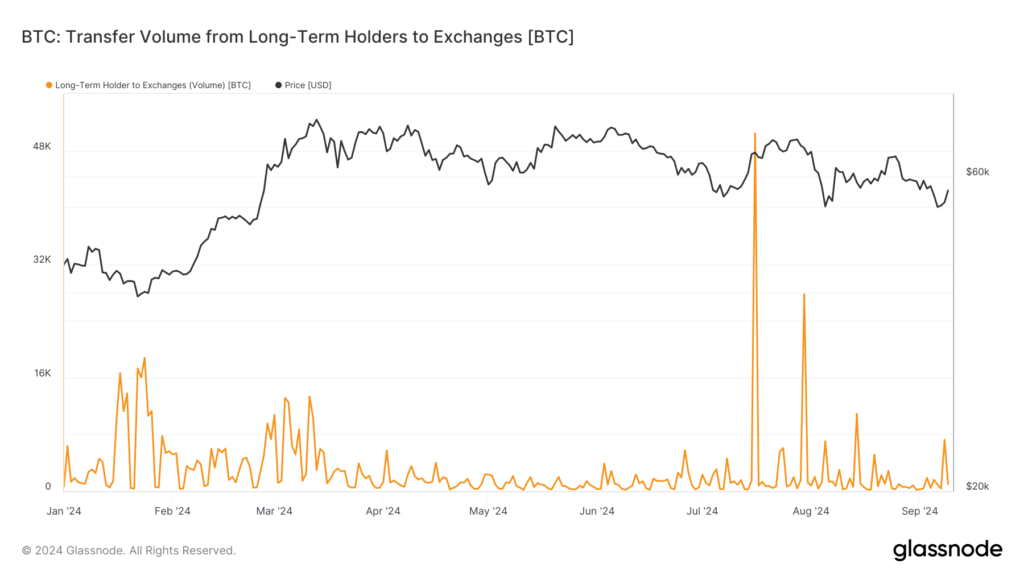

DEFINITION: The total amount of coins transferred from long-term holders to exchange wallets.

Bitcoin’s transfer volume from long-term holders to exchanges reflects shifts in market sentiment. In 2024, this metric remained subdued until brief spikes in July and August, coinciding with slight price drops — suggesting that long-term holders might have taken profits or repositioned.

The overall pattern shows minimal spikes, highlighting a continued reluctance to move assets despite price volatility.

Long-Term Holder to Exchanges: (Source: Glassnode)

Looking back, historical peaks in this transfer volume, particularly in 2017 and 2021, align with Bitcoin’s price peaks, indicating that long-term holders contributed to market liquidity during bullish periods.

In contrast, 2024’s transfer activity remains low, which suggests that long-term confidence persists even as price corrections occur.

Long-Term Holder to Exchanges: (Source: Glassnode)

While previous years show a tendency for transfer volume to rise during bull runs, 2024 reveals a more conservative approach from these holders. This behavior may indicate anticipation of future price growth, with many opting to maintain their positions rather than exit during short-term fluctuations.

The post Long-term Bitcoin holders’ transfer volume remains low amid price corrections in 2024 appeared first on CryptoSlate.

Onchain Highlights DEFINITION: The total amount of coins transferred from long-term holders to exchange wallets. Bitcoin’s transfer volume from long-term holders to exchanges reflects shifts in market sentiment. In 2024, this metric remained subdued until brief spikes in July and August, coinciding with slight price drops — suggesting that long-term holders might have taken profits

The post Long-term Bitcoin holders’ transfer volume remains low amid price corrections in 2024 appeared first on CryptoSlate.