Bitcoin Miners Approach $40B Market Cap as Difficulty Set for Fifth Straight Increase

Publicly traded bitcoin (<a href=”https://www.coindesk.com/price/bitcoin/ ” target=”_blank”>BTC</a>) miners are approaching the milestone of an aggregated $40 billion market cap, according to <a href=”https://farside.co.uk/miners/” target=”_blank”>Farside data</a>, doubling in seven months as bitcoin’s price rocketed through multiple record highs to approach six figures for the first time.

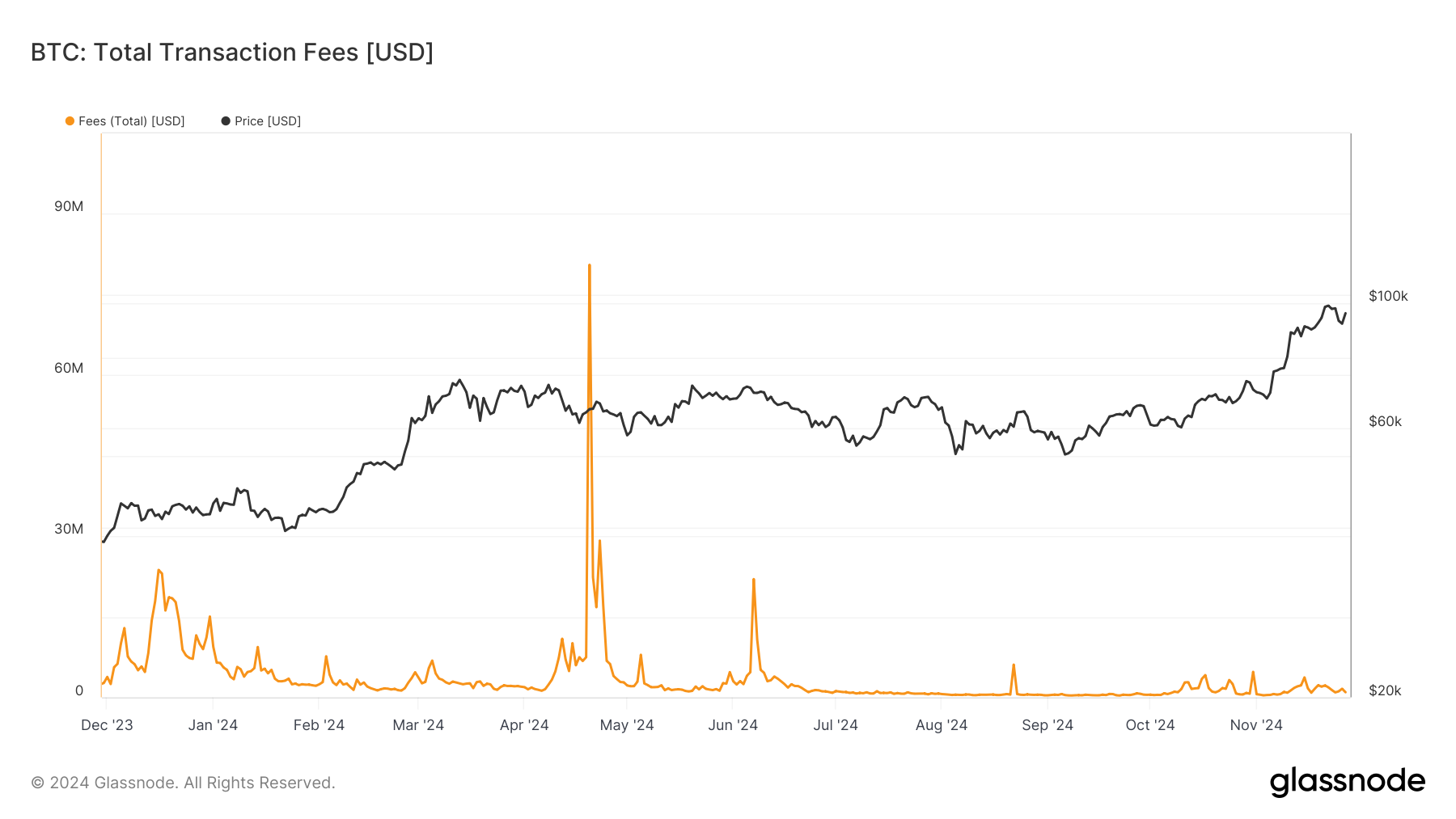

Miners’ biggest challenge is revenue. The reward they receive for confirming blocks on the Bitcoin blockchain was cut <a href=”https://www.coindesk.com/learn/bitcoin-halving-explained” target=”_blank”>50% in April</a>, when their combined market cap was about $20 billion. In this current epoch, only 450 bitcoin are mined a day and fees paid to miners remain at cycle lows, just 10 BTC ($946,000) on Nov. 27 according to Glassnode data.

That means they either have to diversify revenue streams or produce bitcoin at a cheaper cost than the spot price, currently about $96,000.

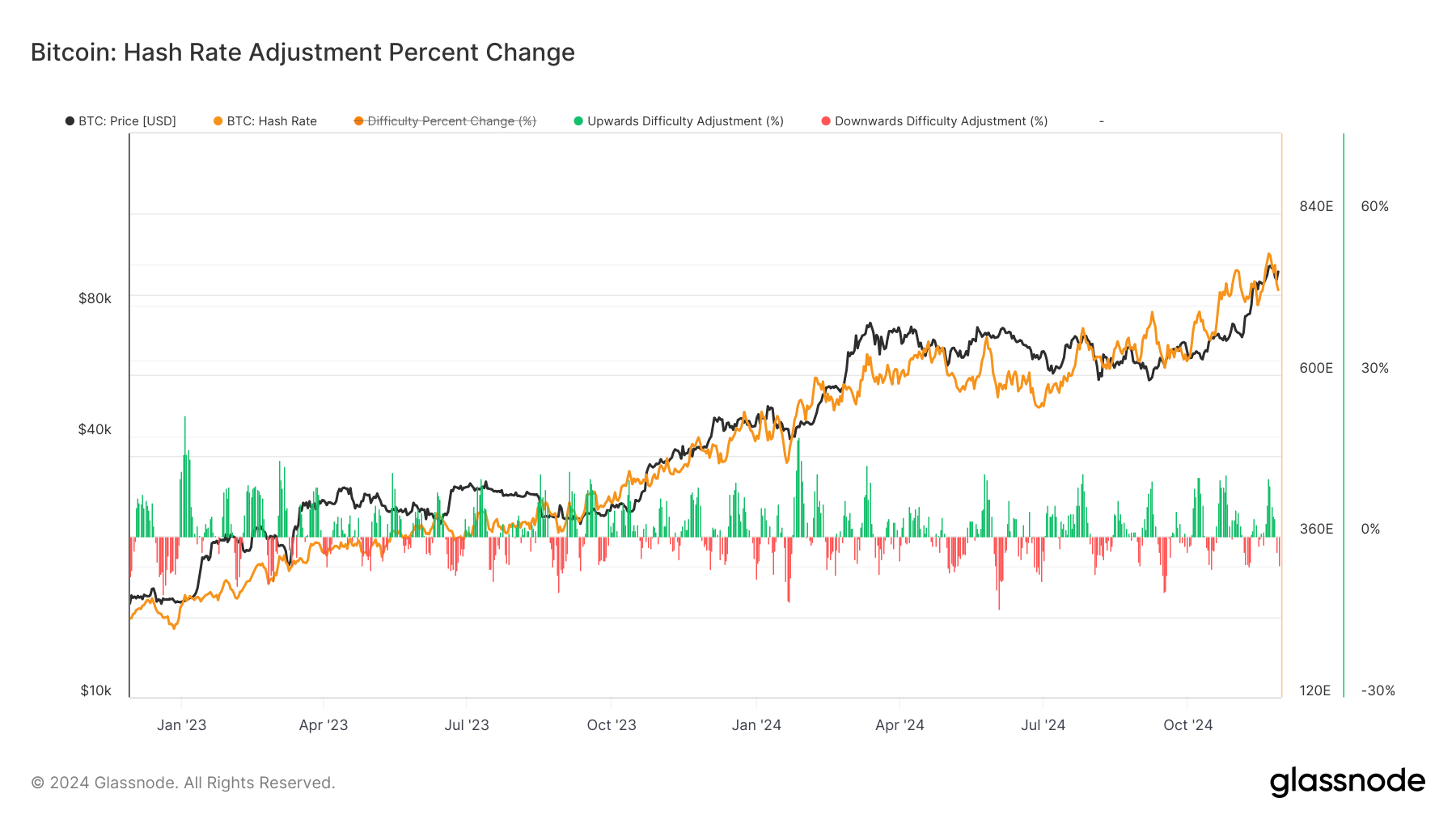

That’s a challenge that is about to become more difficult. The mining difficulty, which measures how hard it is to produce the blockchain’s blocks, is expected to increase by a further 3% at some point in the next few days.

Mining difficulty, already firmly above <a href=”https://www.coindesk.com/markets/2024/11/05/bitcoin-mining-difficulty-tops-100t-for-first-time-piling-pressure-on-small-miners” target=”_blank”>1 trillion</a>, automatically adjusts every 2016 blocks or roughly every two weeks. The higher the difficulty, the harder — and costlier — for miners to produce a new block.

The heart of the issue is the soaring hashrate, which has held above 700 exahash per second (EH/s) for more than a month. The hashrate is the computational power required to mine and process transactions on a <a href=”https://www.coindesk.com/learn/2020/12/16/what-is-proof-of-work/ ” target=”_blank”>proof-of-work blockchain</a> like Bitcoin.

On a seven-day moving average, the hashrate is currently at 726 EH/s, continuing to put in higher highs and higher lows since mid-year, according to Glassnode data.

In 2024, many miners have diversified their revenue streams by pivoting into the AI and high-performance computing (HPC) industries, where there is soaring demand for locations that can host the computing power they need.

One example is IREN (IREN), whose shares surged 30% on Wednesday on <a href=”https://www.coindesk.com/business/2024/11/27/bitcoin-miner-iren-surges-on-renewed-ai-interest-possible-btc-dividend-payment” target=”_blank”>renewed AI interest</a>.

Other, such as MARA Holdings (MARA), are leveraging their bitcoin stashes and bumping up their bitcoin balance sheet holdings. As of Nov. 27, MARA added a <a href=”https://x.com/MARAHoldings/status/1861848253362274469″ target=”_blank”>further 703 BTC</a> after selling a 0% $1 billion convertible note to raise the funds. The company now owns a total 34,794 BTC.

The CoinShares Valkyrie Bitcoin Miners ETF is a proxy for publicly traded miners. Its share price is up 60% year-to-date, which is underperforming bitcoin’s 113%.

Content