Crypto Daybook Americas: Massive Selloff Doesn’t Stop Bitcoin Institutional Adoption

By Omkar Godbole (All times ET unless indicated otherwise)

“I don’t understand how can anyone think BTC is not a bargain at these prices…,” Andre Dragosch, head of research – Europe at Bitwise, said on X Monday as BTC’s price dipped below $90,000.

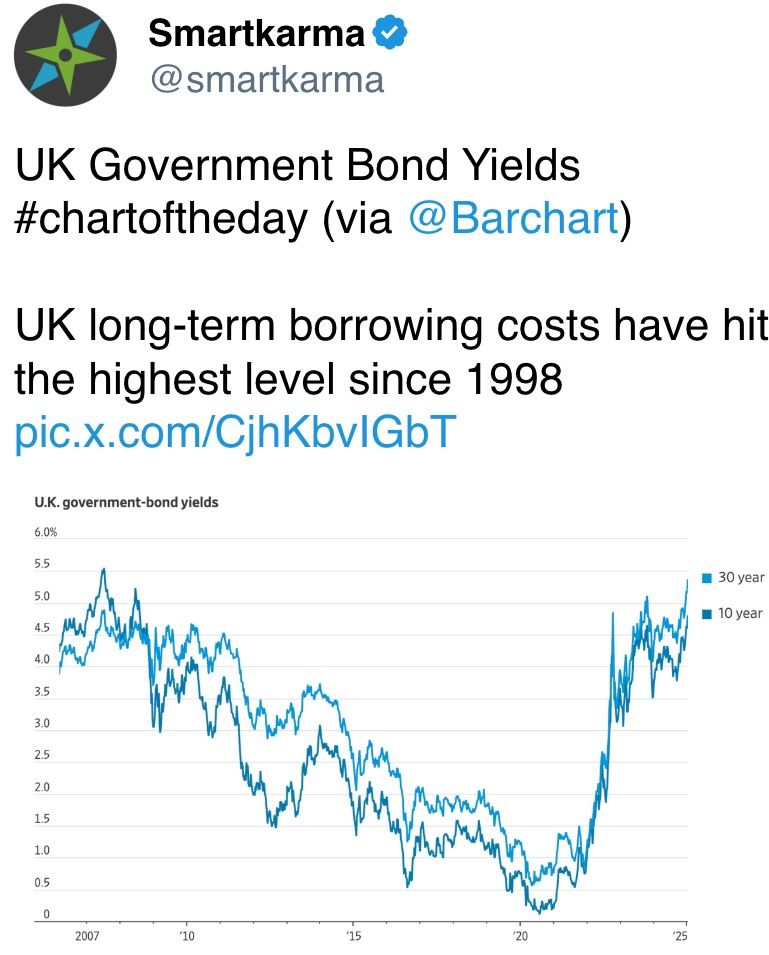

While the comment may appear overly optimistic to macro bears, it is not without justification. Even as the DXY, Treasury yields, and Fed rate expectations look to destabilize risk assets, corporate and institutional demand for BTC continues to strengthen.

Intesa Sanpaolo, Italy’s largest bank by market capitalization, has reportedly purchased BTC, snapping up 11 BTC for $1 million. That could accelerate crypto adoption in the European Union’s third-largest economy, which already has 1.4 million citizens holding cryptocurrencies.

If that’s not enough, corporate Treasury purchases of BTC have already reached 5,774 BTC in the first two weeks of January, outpacing the supply of new BTC.

To Dragosch’s credit, BTC has bounced to over $96K, hinting at an end of the price weakness that began a month ago at record highs above $108K. As usual, that has brought cheer to all corners of the crypto market, with AI, gaming and meme sub-sectors leading the charge.

The recovery, supported by ongoing institutional adoption and rumors of President-elect Donald Trump planning to issue an executive order addressing crypto-accounting SEC rules on day one, suggests that bears may find it difficult to assert their influence.

Prices may move into six figures if Tuesday’s U.S. producer price index points to softer inflation in the pipeline, weakening the hawkish Fed narrative. Note that the dollar index’s rally has already stalled amid reports that Trump’s tariffs will be gradual and smaller than initially feared.

What to Watch

Crypto

Jan. 14, 8:00 p.m.: Degen (DEGEN) mainnet upgrades to ArbOS 32.

Jan. 15: Degen liquidity mining airdrop; snapshots will be taken until the end of Jan. 14 (UTC).

Jan. 15: Mintlayer version 1.0.0 release. The mainnet upgrade introduces atomic swaps, enabling native BTC cross-chain swaps.

Macro

Jan. 14, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases December 2024’s PPI data.

PPI MoM Est. 0.3% vs. Prev. 0.4%.

Core PPI MoM Est. 0.3% vs. Prev. 0.2%.

Core PPI YoY Est. 3.7% vs. Prev. 3.4%.

PPI YoY Est. 3.4% vs. Prev. 3%.

Jan. 14, 8:55 a.m.: U.S. Redbook YoY for the week ended on Jan. 11. Prev. 6.8%.

Jan. 15, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases December 2024’s Consumer Price Index Summary.

Core Inflation Rate MoM Est. 0.2% vs. Prev. 0.3%.

Core Inflation Rate YoY Est. 3.3% vs. Prev. 3.3%.

Inflation Rate MoM Est. 0.3% vs. Prev. 0.3%.

Inflation Rate YoY Est. 2.8% vs. Prev. 2.7%.

Jan. 16, 2:00 a.m.: The U.K.’s Office for National Statistics November 2024’s GDP estimate.

GDP MoM Est. 0.2% vs. Prev. -0.1%.

GDP YoY Prev. 1.3%.

Jan. 16, 8:30 a.m.: The U.S. Department of Labor releases the Unemployment Insurance Weekly Claims Report for the week ending on Jan. 11. Initial Jobless Claims Est. 214K vs. Prev. 201K.

Jan. 17, 5:00 a.m.: Eurostat releases December 2024’s Eurozone inflation data.

Inflation Rate MoM Final Est. 0.4% vs Prev. -0.3%.

Core Inflation Rate YoY Final Est. 2.7% vs. Prev. 2.7%.

Inflation Rate YoY Final Est. 2.4% vs. Prev. 2.2%.

Token Events

Governance votes & calls

Compound DAO is discussing the creation a new unit responsible for managing APR incentive campaigns to attract large conservative investors.

Maple Finance DAO is discussing using 20% of the fee revenue the protocol will generate in Q1 to buy back SYRUP tokens and distributed them to SYRUP stakers.

Unlocks

Jan. 14: Arbitrum (ARB) to unlock 0.93% of its circulating supply, worth $70.65 million.

Jan. 15: Connex (CONX) to unlock 376% of its circulating supply, worth $84.5 million.

Jan. 18: Ondo (ONDO) to unlock 134% of its circulating supply, worth $2.19 billion.

Token Launches

No major token launches scheduled today.

Jan. 15: Derive (DRV) will launch, with 5% of supply going to sENA stakers.

Jan. 16: Solayer (LAYER) to host token sale followed by five months of points farming.

Jan. 17: Solv Protocol (SOLV) to be listed on Binance.

Conferences:

Day 9 of 14: Starknet, an Ethereum layer 2, is holding its Winter Hackathon (online).

Day 2 of 12: Swiss WEB3FEST Winter Edition 2025 (Zug, Zurich, St. Moritz, Davos)

Jan. 17: Unchained: Blockchain Business Forum 2025 (Los Angeles)

Jan. 18: BitcoinDay (Naples, Florida)

Jan. 20-24: World Economic Forum Annual Meeting (Davos-Klosters, Switzerland)

Jan. 21: Frankfurt Tokenization Conference 2025

Jan. 25-26: Catstanbul 2025 (Istanbul). The first community conference for Jupiter, a decentralized exchange (DEX) aggregator built on Solana.

Jan 30-31: Plan B Forum (San Salvador, El Salvador)

Feb. 3: Digital Assets Forum (London)

Feb. 18-20: Consensus Hong Kong

Token Talk

By Francisco Rodrigues

Holoworld AI has announced the start of Agent Market, a Solana-based token launchpad allowing users to create, trade, and interact with on-chain AI agents and their tokens without coding skills. The marketplace has integration with multiple social channels including X, allowing for agents to be deployed on these channels after launch.

Despite enduring a steep correction, AI tokens have outperformed every other basket class within the cryptocurrency space so far this year, owing their returns to a significant surge seen in the first week of the year. CCData’s basket performance shows that year-to-date, AI tokens are up 2.5%, while the second-best performing class, exchange tokens, is up less than 0.5%.

On the other end of the spectrum, real world asset (RWA) tokens are down more than 14% , significantly underperforming memecoins, which dropped roughly 10% in this month’s correction.

Usual Protocol, the popular decentralized finance protocol that came under fire last week over an unexpected change in its redemption mechanism, has activated its Revenue Switch for USUALx holders.

Solana-based token launchpad Pump.fun has moved 122,620 SOL worth over $21 million to Kraken, bringing their total deposited funds to 1.785 million SOL worth $362 million, Onchain Lens revealed.

The FTX estate has executed its monthly SOL redemption transfer, unstaking 182,421 SOL and moving the funds to 20 different addresses. Since November, FTX has redeemed over $500 million in SOL, and it still holds $1.18 billion in its staking address.

Derivatives Positioning

Large cap tokens, excluding XLM, XRP and HYPE, have seen a decline in perpetual futures open interest in the past 24 hours.

Front-end BTC and ETH options risk reversals show neutral sentiment despite the price recovery. Near-dated and long-term options show a bias for calls.

Block flows featured large purchase of calls at $95K and $98K expiring in the next two weeks and an ETH bull call spread, involving March 28 expiry calls at $5.5K and $6.5K.

Market Movements:

BTC is up 2.56%% from 4 p.m. ET Tuesday to $96,615.50 (24hrs: +6.44%)

ETH is up 3.84% at $3,233.91 (24hrs: +5.76%)

CoinDesk 20 is up 4.69% to 3,463.07 (24hrs: +6.84%)

Ether staking yield is up 15 bps to 3.12%

BTC funding rate is at 0.01% (10.95% annualized) on Binance

DXY is down 0.35% at 109.57

Gold is up 0.22% at $2,679.50/oz

Silver is up 0.76% to $30.32/oz

Nikkei 225 closed -1.83% at 38,474.30

Hang Seng closed +1.83% at 19,219.78

FTSE is up 0.17% to 8,237.93

Euro Stoxx 50 is up 1.03% to 5,005.29

DJIA closed on Monday +0.86% at 42,297.12

S&P 500 closed +0.16 at 5,836.22

Nasdaq closed -0.38% at 19,088.10

S&P/TSX Composite Index closed -0.93% at 24,536.30

S&P 40 Latin America closed +0.49% at 2,192.57

U.S. 10-year Treasury was unchanged at 4.79%

E-mini S&P 500 futures are up 0.54% to 5,906.00

E-mini Nasdaq-100 futures are up 0.71% to 21,096.00

E-mini Dow Jones Industrial Average Index futures are up 0.37% to 42,682.00

Bitcoin Stats:

BTC Dominance: 58.52

Ethereum to bitcoin ratio: 0.033

Hashrate (seven-day moving average): 773 EH/s

Hashprice (spot): $54.3

Total Fees: 7.77 BTC/ $721,654

CME Futures Open Interest: 174,105 BTC

BTC priced in gold: 35.6/oz

BTC vs gold market cap: 10.14%

Technical Analysis

Despite the overnight bounce, BTC’s price remains in the Ichimoku cloud, a momentum indicator created by Japanese journalist Goichi Hosada.

A crossover above the cloud would signal a renewed bullish outlook.

Crypto Equities

MicroStrategy (MSTR): closed on Monday at $328.40 (+0.15%), up 3.19% at $338.89 in pre-market.

Coinbase Global (COIN): closed at $251.20 (-2.93%), up 3.18% at $259.20 in pre-market.

Galaxy Digital Holdings (GLXY): closed at C$26.04 (-3.8%)

MARA Holdings (MARA): closed at $17.19 (-3.75%), up 3.61% at $17.81 in pre-market.

Riot Platforms (RIOT): closed at $11.77 (-1.92%), up 3.65% at $12.20 in pre-market.

Core Scientific (CORZ): closed at $13.6 (-3.13%), up 1.6222.22$13.82 in pre-market.

CleanSpark (CLSK): closed at $10.19 (+0.99%), up 3.24% at $10.52 in pre-market.

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $22.22 (-3.85%), up 7.29% at $23.84 in pre-market.

Semler Scientific (SMLR): closed at $52.70 (+2.61%), up 4.19% at $54.91 in pre-market.

Exodus Movement (EXOD): closed at $33.58 (-11.09%).

ETF Flows

Spot BTC ETFs:

Daily net flow: -$284.1 million

Cumulative net flows: $35.94 billion

Total BTC holdings ~ 1.131 million.

Spot ETH ETFs

Daily net flow: -$39.4 million

Cumulative net flows: $2.41 million

Total ETH holdings ~ 3.535 million.

Source: Farside Investors, as of Jan. 13.

Overnight Flows

Chart of the Day

The chart shows performance of various crypto market sub-sectors in 2024.

Memecoins witnessed a staggering 254% gain last year, outperforming the broader market and bitcoin by a big margin.

While You Were Sleeping

Is Bitcoin Bottom In? BTC’s Price Action is Inverse of December Peak Above $108K (CoinDesk): Bitcoin dipped below $90K on Monday as investment banks speculated about potential Fed rate hikes, but it rebounded to $94K, suggesting the price may have temporarily bottomed after recent volatility.

Crypto Bank Sygnum Gets Unicorn Status With $58M Round (CoinDesk): Sygnum, a Switzerland and Singapore-based digital asset bank, achieved unicorn status after raising $58M to support European and Hong Kong expansion, enhanced Bitcoin offerings, and acquisition plans.

Sony’s Layer-2 Blockchain “Soneium” Goes Live (CoinDesk): Sony has launched “Soneium,” a layer-2 blockchain on Ethereum, leveraging Optimism’s OP Stack to connect web2 and web3 audiences while supporting gaming, finance, and entertainment applications.

As the U.S. Dollar Soars, Here Are Europe’s Biggest Winners and Losers (CNBC): The strong U.S. dollar, fueled by higher yields and capital flows, weakens the euro and pound, increasing costs for net importers like Germany and the U.K., while benefiting Norway’s oil exports.

China Will ‘Try Very Hard’ to Slow Yuan’s Fall, UBS’ Wang Says (Bloomberg): UBS says a weaker yuan will offer limited export benefits, as Beijing seeks to slow its decline amid US tariff threats, a strong dollar, and risks of capital outflows.

BOJ Set to Discuss Whether to Raise Rates Next Week (The Wall Street Journal): Deputy Gov. Himino says the Bank of Japan will discuss a potential rate hike on Jan. 23-24, noting inflation trends align with projections. His remarks lifted bond yields, while the yen briefly weakened before recovering.

In the Ether

Your day-ahead look for Jan. 14, 2025