Igor Statsenko

AdminForum Replies Created

-

Igor Statsenko

MemberAugust 23, 2025 at 9:03 pm in reply to: Sobering Macroeconomic Analysis by Henrik ZebergThanks for sharing this, I’ll have to check it out!

-

Celebrating some wins 🏆

26.52% on $RGTI quantum compute stock (in about 1 month!)

32% profit in 1 month on the individual nuclear stocks we bought last month!

— and up 11.48% on $NUKZ ETF

stopped out

$CRCL

$HON

BTW, a lot of these stocks are offered on kraken now as tokenized stocks. If you don’t have a Robinhood or webull and you want to do this in a “crypto” setting then kraken is pretty convenient.

Make sure you’re keeping engaged and diversifying yourself because right now stocks have been crushing it!

Some nice podcasts on AI from Nononsenseforex, I personally wanna find some good metals stocks (copper and others mentioned in podcast) and was inspired by the convo’s from these podcasts

PRECURSOR TO AI EPISODES: https://youtu.be/QElrQZc4Nl0?si=8c9tQ79PIypcyXou

AI EPISODE #1: https://youtu.be/vnQEcC2jfmE?si=ESCB13zBI2iQZ2JG

AI EPISODE #2: https://youtu.be/cmA25G-OLew?si=Fj2C_ZHimKloHe0-

-

This reply was modified 5 months, 3 weeks ago by

Igor Statsenko.

Igor Statsenko.

-

This reply was modified 5 months, 3 weeks ago by

-

💼 A Diversification Opportunity: Nuclear Energy Exposure

We don’t talk stocks much in the ARC community — but outside of DeFi, I personally like to diversify into long-term macro trends when the signals line up.

Lately, nuclear energy has caught my attention.

A newly proposed bipartisan bill is putting real momentum behind the nuclear sector. It’s not a total pivot by the government, but it’s clear nuclear is getting a stronger seat at the table in the future of energy. If we’re moving into an AI-powered, high-demand world, energy security and sustainability become critical — and nuclear checks both boxes.

This video does a great job breaking it down and highlights 5 public companies that offer exposure to this trend:

🧠 My Personal Allocation Strategy

This isn’t advice — just what I’m doing for my own diversification:

- 50% into the NUKZ ETF for safer, broader exposure across the nuclear sector

- 50% split between the 5 stocks covered in the video for higher upside potential

I’m not an expert in nuclear — which is why the ETF gives me coverage, while the individual names give me leverage if any of them become breakout players.

This is what I’d call an asymmetric macro trend — low current exposure in most portfolios, but high potential impact if nuclear plays a key role in the next energy cycle.

DeFi is still home base. But stacking a few bets outside the chain can sometimes be the bridge between volatile innovation and long-term wealth.

-

I asked ChatGPT to rank the 5 companies in order of what it thought had the most potential and the below is the write up it gave me.

I put $2500 into NUKZ for lower risk etf exposure and I’m allocating $2500 into the 5 individual companies with a dynamic allocation where I invest 10% more on each ranked stock to give more fuel to what has better risk/reward and that looks like the image I have attached

The write up from ChatGPT

🔝

1. Centrus Energy Corp. (LEU)

🏆 High Potential, High Risk, High Reward

Why it’s ranked #1:

- First-mover in HALEU (High-Assay Low-Enriched Uranium) — the fuel needed for next-gen reactors.

- $3.4B U.S. government support and clear geopolitical alignment to reduce reliance on Russian supply chains.

- Tiny market cap (~$500M), so even moderate success could yield outsized returns.

Risk:

- Extremely dependent on successful tech execution + government contracts.

- Low liquidity and volatility make it a small-cap landmine or goldmine.

🧠 Sammy says: If you believe in SMRs and advanced reactor tech, LEU is the “picks & shovels” play for the nuclear renaissance.

🧪

2. Oklo Inc. (OKLO)

💡 Moonshot Tech with Political & Silicon Valley Backing

Why it’s ranked #2:

- Developing microreactors for off-grid and defense uses — think “the Tesla of nuclear.”

- Backed by Sam Altman (OpenAI CEO), and just secured a 30-year DoD contract.

- If it executes, it’s a category-definer.

Risk:

- Super early stage. No commercial reactors yet. Timeline to profitability = years.

- Stock recently ran hard, so short-term could be overbought.

🧠 Sammy says: This is the SPAC-y startup bet with a powerful narrative. If it works, it works big. But this ain’t your grandma’s utility stock.

⚛️

3. Cameco Corp. (CCJ)

🦍 The Uranium Blue-Chip

Why it’s ranked #3:

- One of the world’s largest uranium producers.

- Global demand for uranium is rising, and CCJ benefits from long-term supply contracts.

- Also has a stake in Westinghouse (reactor services), giving it vertical integration.

Risk:

- Already fairly priced by the market — not a hidden gem.

- Still vulnerable to uranium price swings and geopolitical instability (Kazakhstan, etc.).

🧠 Sammy says: The “safe” pick if you want pure uranium exposure. Think of it as the NVIDIA of uranium: strong positioning, but not early-stage cheap.

🏗

4. NuScale Power (SMR)

📉 First Mover That Got Clipped

Why it’s ranked #4:

- The first and only U.S. SMR design approved by regulators.

- Tech is validated, but execution has struggled — canceled projects and rising costs.

- Market cap is low now, so there’s rebound potential… if they can fix the narrative.

Risk:

- Big credibility hit after walking away from the Utah project.

- Could get passed by more agile or better-funded competitors like Oklo.

🧠 Sammy says: NuScale had first-mover advantage but fumbled the bag. Could be a comeback story, or could just stay stuck in R&D purgatory.

⚡

5. Constellation Energy (CEG)

💰 The Cash Cow Utility

Why it’s ranked #5:

- Largest fleet of nuclear reactors in the U.S. — real revenue, real power.

- Long-term contracts with companies like Meta = stability.

Risk:

- This is not a growth play — it’s a defensive utility stock.

- Already ran up big after the Meta deal; further upside may be limited.

🧠 Sammy says: If you want dividends and slow, steady growth — sure. But this ain’t what you buy if you’re looking for asymmetric upside in the nuclear sector.

p.s. Sammy is my ChatGPT’s persona of financial analyst and CIO

-

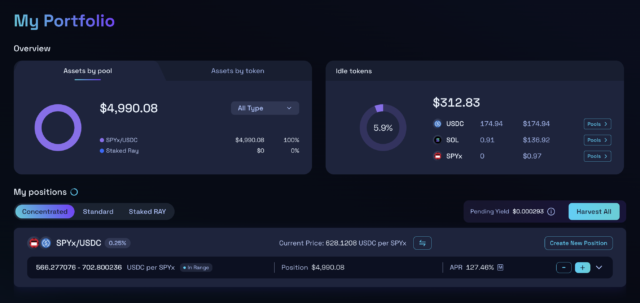

STOCK MARKET CLOSED TILL MONDAY: IM TIGTHENING MY RANGE ON SPYx/USDC

Stocks wont trade again until monday and the stock market is closed right now for independence day

Im taking advantage of this 3 day weekend coming up by tightening my range on SPYx/USDC to $616-$638

I will bring it back to my wider range of $566-$702 on Sunday Night/Monday Morning

-

This reply was modified 7 months ago by

Igor Statsenko.

Igor Statsenko.

-

This reply was modified 7 months ago by

-

Just put $5.5k into CRCL stock. I did this inside my roth IRA but for anyone interested in buying it inside of DeFi you can now buy CRCLx on Raydium

First setup a phantom wallet: https://chromewebstore.google.com/detail/phantom/bfnaelmomeimhlpmgjnjophhpkkoljpa?pli=1

To buy stock tokens on Raydium you need funds in your phantom wallet, bridge from rabby to phantom using Portal (if it’s your first time then check the box to add some SOL to the wallet so you have gas): https://portalbridge.com/

Here is a convenient link you can use to buy CRCL from your Solana wallet: https://raydium.io/swap/?inputMint=EPjFWdd5AufqSSqeM2qN1xzybapC8G4wEGGkZwyTDt1v&outputMint=XsueG8BtpquVJX9LVLLEGuViXUungE6WmK5YZ3p3bd1&referrer=HJhTe8CSkhMh4ikbutJFXfXmuynRLzxJDoHoHiNnjdSr

Trade details:

Stop loss: 169.55

Take Profit $365

Entry: $187.40Risking $500 on this trade to make $5000

#NFA

-

This reply was modified 7 months ago by

Igor Statsenko.

Igor Statsenko.

-

This reply was modified 7 months ago by

-

I just took $5k from my FXB pools and added it to the SPYx/USDC pool on raydium. This should be a relatively stable and high income generating pool. 127% Estimated APR. My range is below, we will be covering this in more detail during this weeks classes!

Please support the ARC and use this link to buy your SPYx if you’re setting up this pool: https://raydium.io/swap/?inputMint=XsoCS1TfEyfFhfvj8EtZ528L3CaKBDBRqRapnBbDF2W&outputMint=EPjFWdd5AufqSSqeM2qN1xzybapC8G4wEGGkZwyTDt1v&referrer=HJhTe8CSkhMh4ikbutJFXfXmuynRLzxJDoHoHiNnjdSr

-

This reply was modified 7 months ago by

Igor Statsenko.

Igor Statsenko.

-

This reply was modified 7 months ago by

-

There is a bridge called Squid Router. I’d try that

-

ADDED A BULLET TO MY $TAO TRADE ON GAINS

Just recorded myself adding a bullet to my $TAO trade on gains. Check it out in the drive folder below

This is an excellent time to be buying the dip on some of our favorite blue chip cryptos and adding to those low leverage trades!

not financial advice, just what I’m doing currently

VIDEO TUTORIAL ON PHONE:

https://drive.google.com/file/d/1C7XsfwoBcEQE07URYImsDoQukFFCABhc/view?usp=drivesdk

-

This reply was modified 7 months, 4 weeks ago by

Igor Statsenko.

Igor Statsenko.

-

This reply was modified 7 months, 4 weeks ago by

-

On piggy back of post and loom i just recorded getting into Bittensor Subnets

LOOM GUIDE: https://www.loom.com/share/18dfffa00be7405f8c4ffef52bf0ccbe?sid=11c0286b-cccd-4b1d-9e66-5bb8b4ddb56c

When my bridge completed, I DCA’d the below after doing some more research 🔥

Watched this video (these are the bluechips of the subnets so thats why the bigger allocation): youtube.com/watch?v=sItguC9if0s

- Allocated 1.25 TAO into Chutes

- Allocated 1.25 TAO into Celium

Watched this video: youtube.com/watch?v=BzxnYw7mfUI

- Allocated 0.33 TAO each into:

- FLock (SN96)

- Masa Agent Arena (SN59)

- RedTeam (SN61)

Watched this video: youtube.com/watch?v=mQacmp9WMlw

- Allocated 0.25 TAO into:

- 404-GEN (SN17)

- Dippy Speech (SN58)

From the earlier video:

- Allocated 0.5 TAO into each

- TaoHash (SN14)

- SubVortex (SN7)

- Templar (SN3)

Did some extra research and spread smaller positions across high-potential plays:

- Allocated 0.1 TAO each into:

- Chunking (SN40)

- Precog (SN55)

- Infinite Games (SN6)

- Sturdy (SN10)

- Score (SN44)

- Vericore (SN70)

Bit of a spray and pray on this last batch. I’ve got high conviction that some of these will be standout performers — and we’re still early in this subnet wave. Let’s see how it plays out.

-

This reply was modified 8 months ago by

Igor Statsenko.

Igor Statsenko.

-

This reply was modified 8 months ago by

Igor Statsenko.

Igor Statsenko.

-

I still haven’t bought any, it’s a pain to move stock between 2 brokers… trad fi creates so much friction… but looking at metaplanets price action it looks to not have done much in terms of moving with this wave so maybe the slowmo is better than the fomo on this one

-

I personally setup a 50/50 pool for ultimate stability as I’m not treating this as anything but an income play.

-

I’m just looking for a better entry to add more capital, I will be adding some more today but for a play where I borrow against btc to get in I want to wait for some pull back to lower my risk