Igor Statsenko

AdminForum Replies Created

-

-

-

-

I have been rotating a lot of my XRP to LINK. And personally have rotated pretty much all my BTC and ETH into LINK. This one has shown some amazing strength.

I opened a position on OM as well, mine is on leverage on MEXC.

If you want to leverage it in DeFi you can do so on Gains.Trade

-

STOCK MOVES:

In my Roth I followed chicken genius’ recent move he shared on X and I sold all of my COIN for MSTR.

MSTR is a leveraged bitcoin play now so as the price of bitcoin keeps rising I’m expecting to see a lot of profit come from this stock in my Roth IRA.

MSTR- Microstrategy 🚀

-

This is a good place to accumulate some crypto. My plans for this weekend are to buy more AI Agents (from lists previously shared in the thread) and to buy more ISO20022 coins. Currently my portfolio is pretty much all in on XRP but I will be looking to convert about 20%-40% of my holdings and buying some XLM and HBAR. I’m already in some light leverage trades on all 3 in my personal hyperliquid (don’t worry Aquarius MV, we got some healthy positions in these as well).

When the market falls, we need to weed out the strength. If you’ve noticed, SUI has been holding up incredibly well. This maybe a good one to accumulate more of, I personally feel comfortable with my position (spot holdings and liquid staked) and I haven’t taken any profit on it so I will continue riding it.

Some more things I wanna do this weekend. Take any GMX I have in my wallets and convert it all to HYPE. Hype is proving itself as the leading perp DEX and their product is 1000X better than GMX.

I also want to take all my other shitcoins that haven’t been doing much and rotating it into GRASS and some other stronger and more relevant coins.

Stay tuned for todays Saturday School because @jeordan will be covering some alpha around ai agents and some liquidity pool opportunities for them.

-

Nice 40 mins loom special where i workshop some of the ways we can use the SSL Hybrid on a short timeframe pairing with risk management to win big when these trade opportunities arise

Loom: https://www.loom.com/share/b3069b65ea9b4dabbdc2ed854a975c0a?sid=73af10e1-c817-4e42-a53f-a49c5de84ca5

-

GOLD TRADE SETTING UP

Look at the attached chart of gold. You can see that it is forming a strong consolidation pattern.

The last two time gold has formed a pattern like this it’s gone into a 2-3 month extension.

Whats nice about gold is it’s volatility is much lower so it can be traded with higher leverage.

I personally think this could create a good trading opportunity to monitor the breakout and take trades on shorter timeframes with tight stop losses and higher leverage.

I’ll show an example below this post

-

🎆 YEARLY $TOTAL MARKETCAP RETEST 🎆

We just had a huge event happen in the market and we’ve experienced our first retest of the yearly candle open.

This should be acting as a significant place of support. Let’s see if Jay Powell saves the market with his speech tomorrow or if he will crash them further. Hope for the best and prepare for the worst.

I DCA’d those AI AGENTS I posted about yesterday, I think these will be some strong runners this bull run with the strength they’ve showed us already.

I also opened some light leverage trades on HBAR, XLM and XRP in about equal proportion

#NFA and stay safe

-

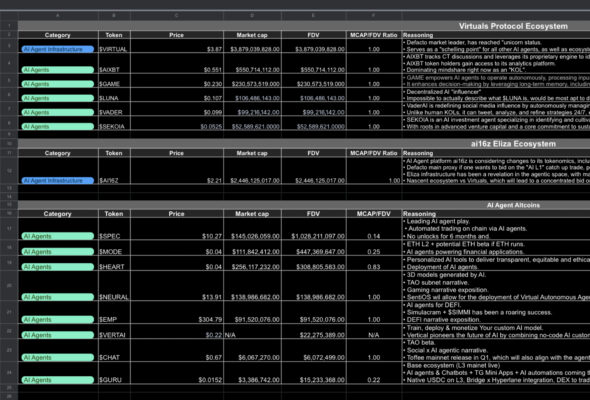

Community Announcement: AI Agent Investment Insights

Hey, everyone!

Today, I want to share something exciting—a breakdown of how I’m approaching a hypothetical $10K investment (or less) in the AI Agent and Infrastructure ecosystem, an area with massive potential for growth. Let me start by saying this isn’t financial advice, but rather an educational framework you can use to make better-informed decisions for your own portfolio.

Also, this is a great way to take advantage of the dip currently happening. Economic data came out weaker then expected, it’s a slight risk, but I do see things running far longer for the rest of the year so I’ll likely DCA $5k today and $5k tomorrow to spread my purchases. Again, not financial advice!!!

How This Plan Works

This approach blends two key strategies to balance risk and reward:

1. Equal Allocation (50%)

Half of the $10K is split equally across all tokens, ensuring a diversified portfolio where every project gets exposure, regardless of size or market cap.

2. Proportional Allocation (50%)

The other half is weighted by market cap. Larger projects like $VIRTUAL and $AI16Z get higher allocations due to their established positions, while smaller projects like $GURU and $CHAT receive less. This ensures the portfolio aligns with the relative strength and maturity of each token.

For example, a token like $VIRTUAL received ~$2,746 (due to its massive market cap dominance), while $GURU received ~$359, blending stability and upside potential from smaller caps.

Why AI Agents?

AI agents are becoming the backbone of innovation, from personalized AI tools to decentralized influencers and autonomous decision-making protocols. The tokens on this list reflect ecosystems with real use cases, early traction, and potential for explosive growth.

Full Credit to Coach Tom!

A huge shoutout to Coach Tom (aka Obiwan Cryptobi) for sourcing this list from an exclusive alpha community he’s a part of. Tom is a seasoned DeFi coach, and his ability to distill valuable insights like this is second to none. His meticulous eye for opportunities ensures that we can explore promising projects that might otherwise fly under the radar. If you’re not following his work, you’re seriously missing out on next-level alpha!

Educational Takeaways

Here are a few lessons from this exercise:

1. Diversification Matters: Balancing exposure across tokens helps mitigate risks, especially in emerging sectors like AI.

2. Market Cap Awareness: Larger caps provide stability, while smaller caps carry higher risk and higher reward potential.

3. Research First: Whether it’s market cap, FDV, or utility, make sure you fully understand a token before allocating funds.

Disclosure

I’m sharing this purely for educational purposes. This isn’t financial advice, and every investment carries risks. Always DYOR (do your own research) and consult a financial advisor if needed.

Let’s keep the conversation going—what are your thoughts on AI tokens? What’s your approach to balancing risk vs. opportunity?

Thanks again to Coach Tom for his guidance, and let’s keep leveling up together so we all WIN BIG in 2025!

-

Portfolio Update: Strategic Moves Inspired by Chickengenius 🐋

Hey everyone,

I’m excited to share my latest portfolio updates with you. After closely analyzing the positions of Chickengenius, a whale wallet I came across on Debank, I decided to strategically allocate $5,000 in my dragon portfolio in alignment with his portfolio proportions. This move wasn’t about copying—it’s about identifying smart money flows and leveraging their insights to optimize my own strategy.

Can review my dragon portfolio on debank here: https://debank.com/profile/0x4d218b3a9a7382041b4b7ec49b050762c8f64e8d

Here’s the breakdown of my allocations, along with the percentage of the total portfolio each position represents:

New Allocations ($5,000):

- AIXBT: $2,736.31 (54.7%)

- FJO: $471.51 (9.4%)

- Mog: $415.16 (8.3%)

- APU: $377.11 (7.5%)

- SEKOIA: $360.88 (7.2%)

- SERAPH: $175.99 (3.5%)

- LOGX: $241.82 (4.8%)

- wQUIL: $163.37 (3.3%)

- SAINT: $56.75 (1.1%)

BONUS AI AGENT PLAY – AGI (Delysium): $1000

BONUS PLAY #2 STRDY – $1000

BONUS PLAY #3 LUNA (by virtuals): $1000Adding a bonus AI Agent Play

While executing this strategy, I identified an area where my portfolio needed improvement: AI Agent projects. To address this, I’m adding an additional $1,000 allocation to AGI (Delysium). This is a cutting-edge project in the AI Agent space and came highly recommended through alpha reports from Coach Ryan. AI-driven infrastructure is the next frontier, and I’m confident this addition positions me well for future growth in this sector. There was also a different wallet linked to chicken genius with a nice holding of LUNA as well as STRDY.

Why This Strategy?

- Strategic Alignment with Smart Money: By allocating in proportion to Chickengenius’ portfolio, I’m positioning myself alongside proven market players. This is not about following trends blindly—it’s about recognizing opportunities and acting decisively.

- Diversification and AI Exposure: My portfolio needed stronger representation in emerging technologies like AI Agents.

- Confidence in Execution: Every move I make is based on careful analysis, not speculation. The 20x gains in Virtual, which I missed, reinforce the importance of acting swiftly when opportunities arise. While I didn’t capture it this time, I’m building the habit of executing with precision.

Proportional Allocation Philosophy

Following a whale like Chickengenius isn’t about replication—it’s about alignment. Their success offers clues about market sentiment and trends, but ultimately, the decision to act is mine. Allocating by percentage ensures my portfolio remains balanced and adaptable to future opportunities.

What’s Next?

I’ll be monitoring these positions closely, staying proactive in identifying high-potential plays, and continuing to refine my portfolio for maximum impact. This is just the beginning—2025 is shaping up to be a game-changing year for crypto, AI, and beyond.

Let me know how your portfolios are shaping up and what plays you’re watching!

Stay sharp and decisive,

Igor -

dragon for time being

-

50% is in AAVE but we have $0 in loans