Scorpio I: High-Yield Trend Trading with Dynamic Risk Scaling

Scorpio I is the original and most aggressive strategy in the Scorpio lineup, designed to deliver maximum upside through high-leverage, trend-based trading systems. It trades exclusively in Bitcoin (BTC) and Ethereum (ETH) and operates as a portfolio of ten distinct algorithmic systems, each built to identify and capitalize on momentum shifts and trending price movements. This strategy doesn’t just seek volatility, it thrives in it, aiming to extract value from strong directional movements, whether the market is rising or falling.

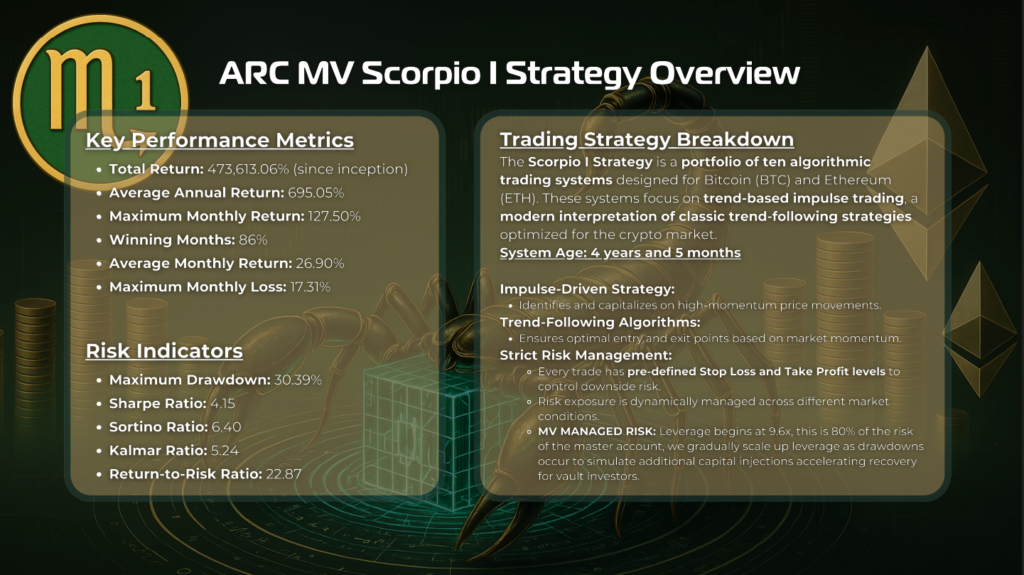

What sets Scorpio I apart is its impulse-driven approach to trend trading. The algorithms are calibrated to detect high-momentum setups, entering trades at optimal inflection points and exiting before momentum wanes. Unlike many retail trend strategies, Scorpio I does not rely on manual judgment or simple indicators, its decisions are the result of machine-optimized logic tested across years of historical data. Every trade is automatically assigned a pre-defined stop loss, ensuring that risk is accounted for before execution. This structure enforces a strict risk ceiling while allowing the system to pursue aggressive returns.

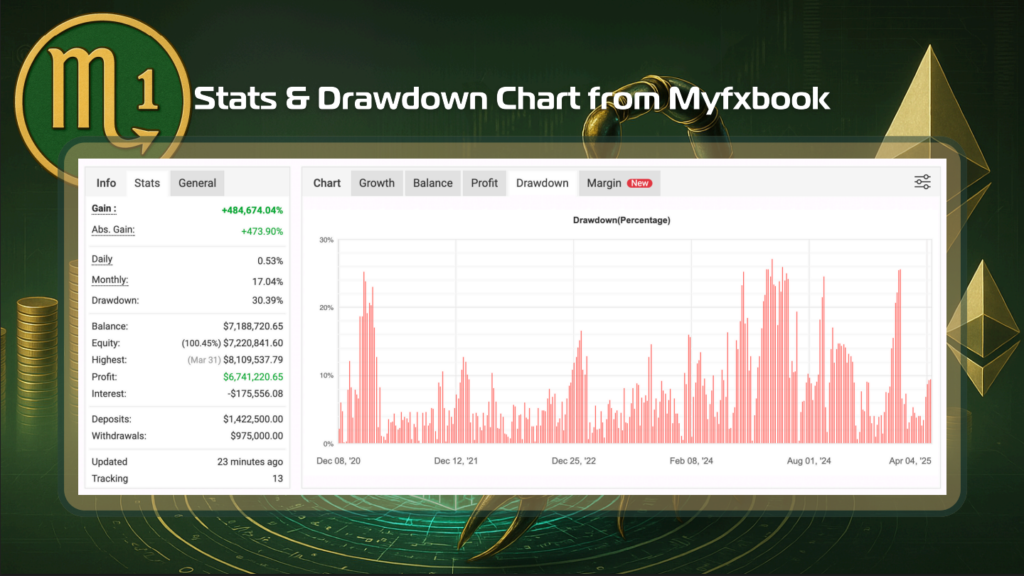

The strategy’s leverage mechanics are also uniquely intelligent. While it typically begins trading at 9.6x leverage, this level is intentionally conservative relative to its full capacity. When drawdowns occur, Scorpio I activates a capital-scaling mechanism that simulates additional investment by gradually increasing leverage. This technique mirrors the effect of injecting more capital during a downturn, helping accelerate recovery, all without requiring investors to manually add funds. It’s a sophisticated solution to a common challenge in leveraged systems: how to regain lost ground efficiently without overexposing the portfolio.

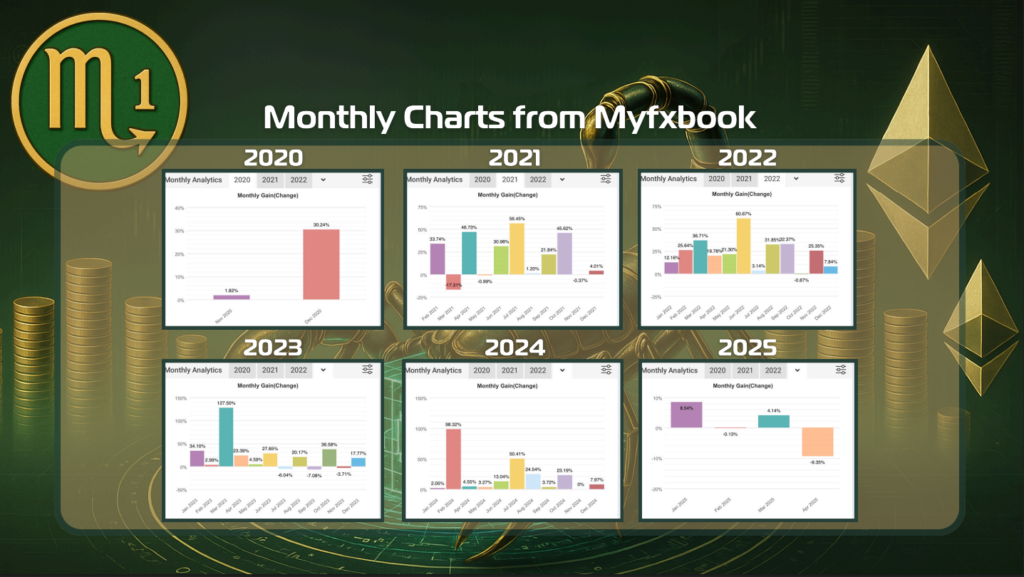

Scorpio I’s historical performance is remarkable. Since inception, it has delivered a total return of over 473,000%, with an average annual return of nearly 700%. Its average monthly gain sits at 26.9%, and it has recorded a maximum monthly return of 127.5%, reflecting its ability to seize large moves in crypto markets. Despite this aggressive upside, the maximum historical drawdown is just over 30%, a figure that speaks to its built-in risk discipline. Additionally, its risk-adjusted metrics, such as a Sharpe ratio of 4.15, Sortino of 6.40, and Return-to-Risk ratio of 22.87, place it well above industry benchmarks for high-performance systems.

This strategy is best suited for investors who are comfortable with volatility, understand the mechanics of trend trading, and want exposure to a fully autonomous, high-octane system. It is ideal for those seeking to compound aggressively over time, particularly when the market enters sustained directional phases. While not for the faint of heart, Scorpio I is engineered to deliver the kind of results most traders only dream about, provided its risk profile fits the investor’s temperament and time horizon.

Scorpio I has been operating successfully for over four years and is currently deployed through ARC’s Enzyme vault infrastructure, where users can participate passively while still benefiting from the strategy’s speed, sophistication, and compounding advantages. As with all Scorpio vaults, participation requires Supernova NFT ownership and whitelisting through ARC’s members portal.