Scorpio II: Long-Term Growth Through Balanced Trend Allocation

Scorpio II is the strategic counterbalance to the high-octane Scorpio I. While still built for strong returns, Scorpio II is crafted with a long-term investor in mind, someone who wants to grow wealth meaningfully over time while minimizing the emotional and financial stress of large drawdowns or short-term volatility. It’s a composite strategy that allocates capital between two complementary systems, aiming to optimize risk-adjusted returns across full market cycles.

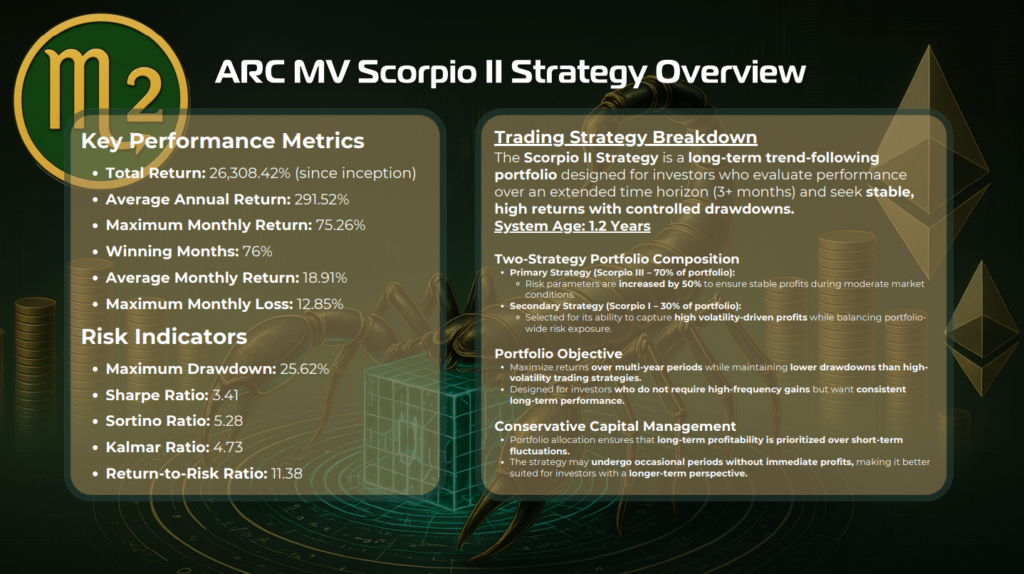

The core of Scorpio II is a dual-strategy portfolio: 70% of capital is allocated to an enhanced version of Scorpio III, while the remaining 30% is placed in Scorpio I. This blend is intentional. Scorpio III brings a more conservative, trend-following framework with lower volatility and steadier performance. Scorpio I, in contrast, is known for its aggressive, high-reward potential during major momentum phases. Together, they form a well-balanced pairing that reduces the portfolio’s exposure to extreme volatility while still retaining meaningful upside potential.

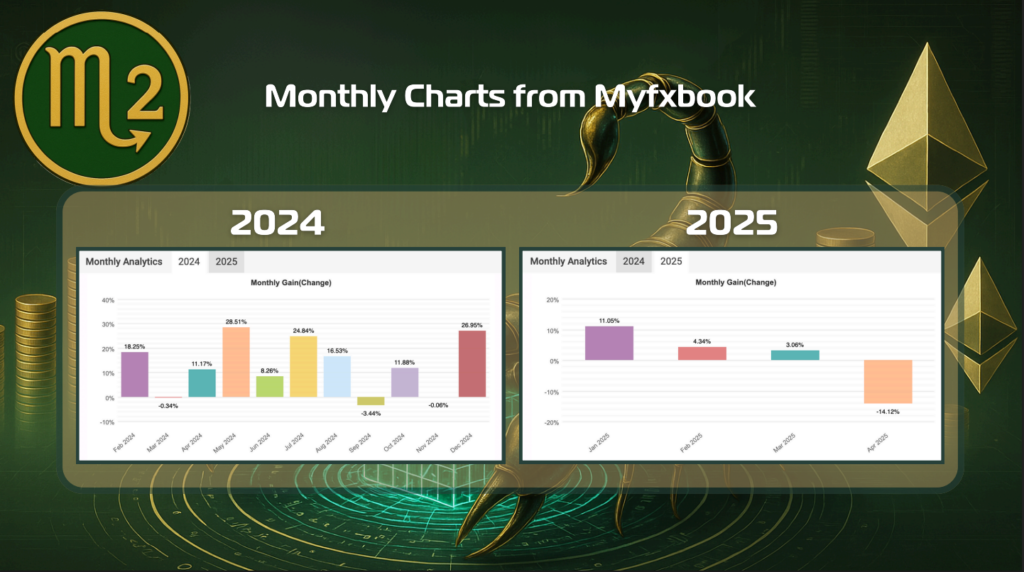

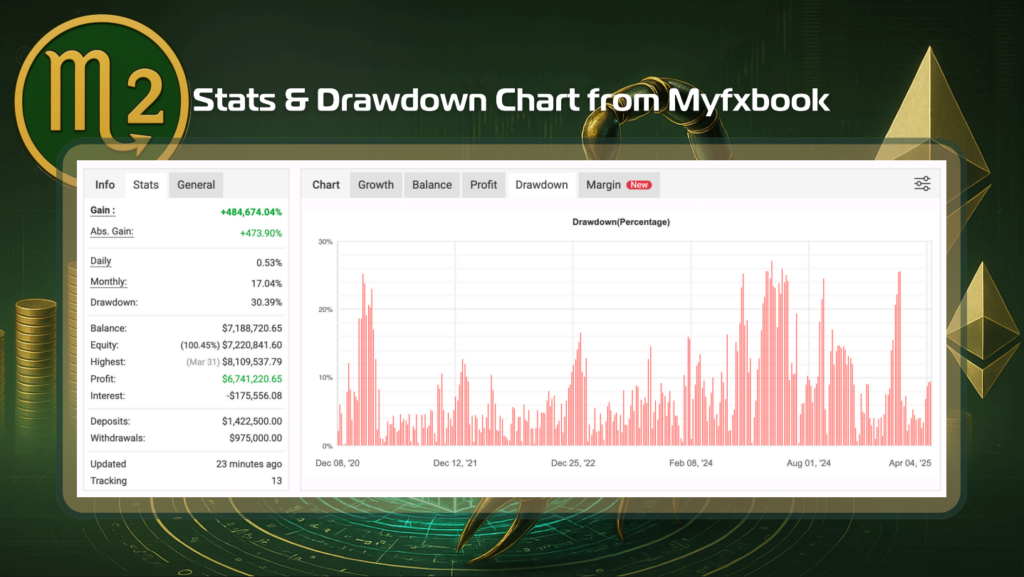

One of Scorpio II’s defining characteristics is its conservative capital management. Rather than pursuing constant high-frequency gains, it focuses on long-term profitability, often operating through periods of low activity or marginal movement in order to position itself for major breakouts. This pacing is a feature, not a flaw. It allows the strategy to avoid overtrading and wait patiently for environments where its systems can perform best. Investors are encouraged to evaluate performance on a multi-month or even multi-year basis, as this timeframe reveals the strategy’s true strength in compounding capital through trending markets with lower risk exposure.

Performance metrics reflect this philosophy. Since inception, Scorpio II has generated a total return of over 26,000%, with an average annual return of nearly 292%. Monthly returns average just under 19%, while the maximum drawdown is limited to 25.6%, notably lower than its more aggressive counterpart. Its Sharpe ratio of 3.41, Sortino of 5.28, and Kalmar ratio of 4.73 indicate a strong balance between returns and volatility, making it one of the more risk-conscious strategies in the Scorpio suite.

Scorpio II is especially attractive to investors who value long-term stability and consistent growth over explosive short-term profits. It is well-suited for those who prefer to “set and forget” their investment while still maintaining exposure to cutting-edge algorithmic strategies. This approach appeals to a wide range of crypto investors, from those rotating out of high-risk DeFi protocols into something steadier, to those with larger allocations looking for smart, low-intervention yield generation across bull and bear cycles alike.

Like all Scorpio strategies, Scorpio II is deployed through ARC’s Enzyme vault infrastructure, where capital compounds automatically in a tax-deferred environment. Access requires at least one Supernova NFT and successful whitelisting. While it may not make headlines for monthly spikes, Scorpio II quietly builds wealth through smart capital allocation, risk-aware design, and a disciplined focus on macro-level trend opportunities.