Scorpio III: Diversified Trend Exploitation with Institutional Precision

Scorpio III is a balanced yet powerful strategy within the Scorpio ecosystem, designed to capture market inefficiencies and trend opportunities across Bitcoin (BTC) and Ethereum (ETH). It represents the middle ground between the aggressive tilt of Scorpio I and the long-term conservatism of Scorpio II. This makes Scorpio III especially attractive to investors seeking a strategic blend of scalability, adaptability, and risk-managed growth.

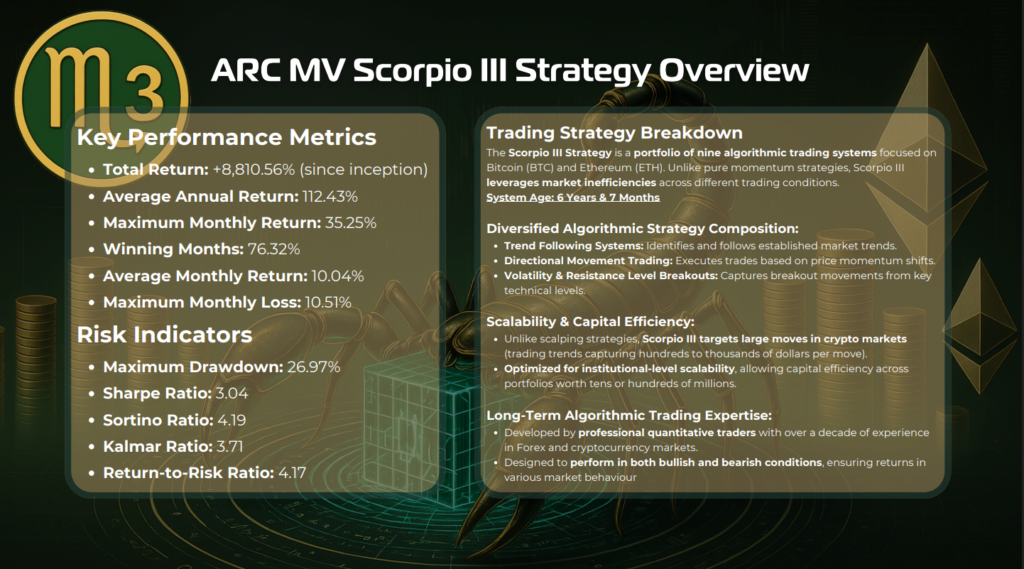

Built around a portfolio of nine algorithmic trading systems, Scorpio III targets momentum shifts and directional price movement using a sophisticated multi-system design. These systems are not limited to one kind of market behavior. Instead, they analyze trend continuations, volatility breakouts, and resistance level breaches, allowing the strategy to adapt across various market cycles. This structural versatility allows Scorpio III to perform during bull runs, bear trends, and sideways markets with occasional momentum pockets. Unlike high-frequency strategies that rely on constant scalping, Scorpio III seeks larger, more sustainable moves, giving it more breathing room and reducing the erosion from over-trading.

A unique strength of Scorpio III is its scalability. The strategy is optimized for institutional-level capital management, capable of operating efficiently with allocations in the tens or even hundreds of millions without degrading performance. This is rare in the crypto algorithmic space, where many models are capacity-constrained or lose edge under pressure. Scorpio III, by contrast, has been specifically designed with high capital efficiency in mind, making it well-suited for both individual and institutional investors seeking durable trading logic.

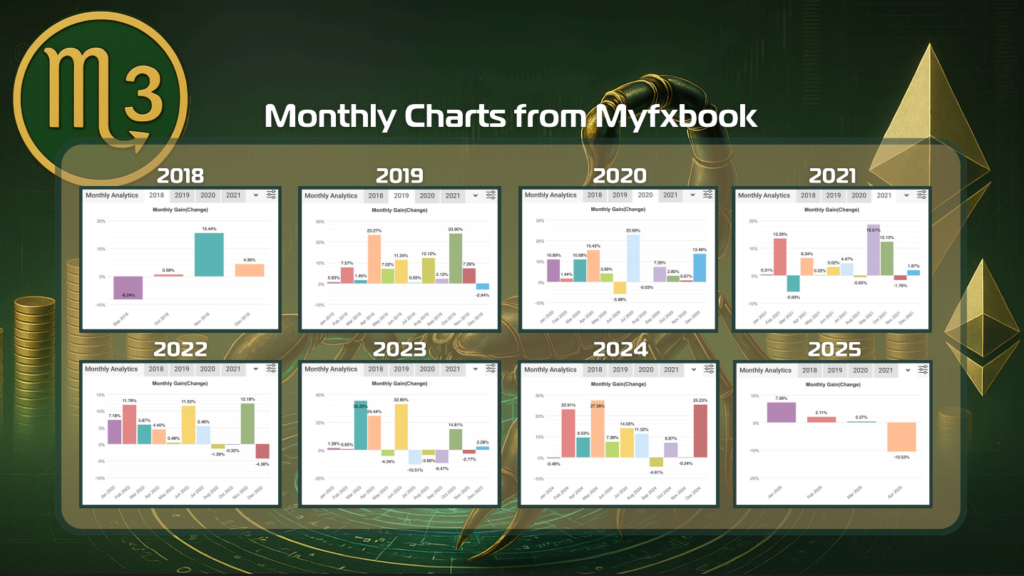

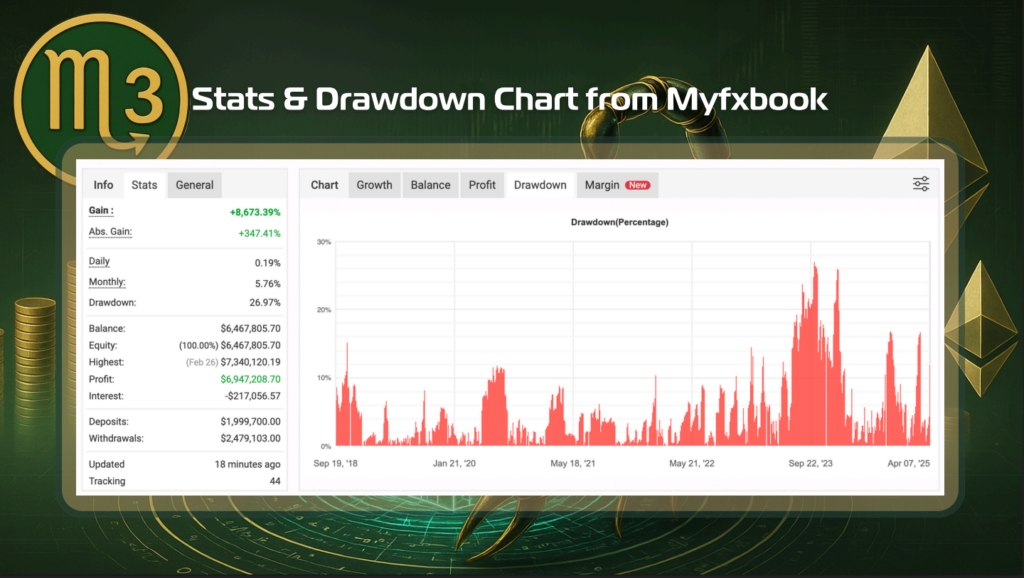

In terms of performance, Scorpio III has delivered a total return of 8,810% since inception, with an average annual return of over 112%. It maintains a monthly average return of 10.04% and a maximum drawdown of just under 27%, putting it firmly in the category of high-performance, moderate-risk strategies. With a Sharpe ratio of 3.04 and a Sortino ratio of 4.19, Scorpio III demonstrates a stable return profile, capable of delivering meaningful gains while avoiding outsized downside events.

Another key advantage of Scorpio III is its longevity and proven adaptability. Having been live for over six years, it has traded through multiple bull and bear markets, accumulating a robust live performance record that reflects both strong market timing and conservative capital preservation. It has shown that it doesn’t need extreme market moves to generate results. It simply requires conditions where trends form and momentum builds, regardless of the overall sentiment.

Scorpio III is ideal for investors who want structured, institutional-grade exposure to crypto market cycles without embracing the more intense volatility of higher-leverage strategies. It’s particularly well-suited for those who appreciate algorithmic transparency, diversified trading logic, and a proven track record. Whether used as a standalone strategy or as part of a multi-vault allocation plan, Scorpio III offers reliable trend engagement with the professional rigor expected of a managed vault.

As with all Scorpio strategies, access to Scorpio III is gated behind the Supernova NFT system and facilitated through the Enzyme vault platform, where investors benefit from tax-deferred compounding and passive participation.